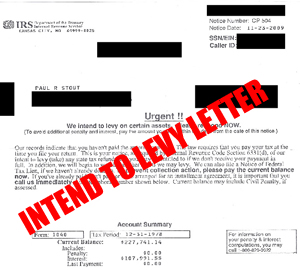

A district court has approved IRS's levy on taxpayers' principal residence, noting that:

1) IRS established that there were no reasonable alternatives for collection;

2) IRS's determination that the taxpayers were ineligible for an offer in compromise was correct; and 3) taxpayers' pending installment agreements didn't prohibit the levy.

(Gower, (DC FL 7/10/2018) 122 AFTR 2d ¶ 2018-5033).

Have and IRS Levy Problem?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation Contact us at:

or Toll Free at 888-8TaxAid (888 882-9243).

Read more at: Tax Times blog