According to just notice that the IRS ACS is now sending Notice LT11 instead of Letter 1058-C "Final Notice of Intent to Levy."

The IRS Automated Collection Systems (ACS) has stopped using Letter 1058-C “Final Notice of Intent to Levy,” and instead, is using Notice LT11 (Note: Revenue Officers are still using Letter 1058).

This is a rather important change as the Final Notice of Intent to Levy is what every tax dispute practitioner is on the look out for so as to file a Collection Due Process or Equivalency Hearing.

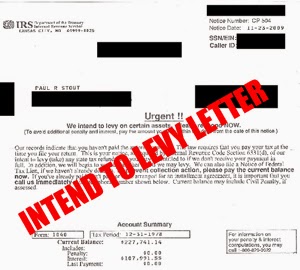

The new IRS Notice LT11 looks fairly innocuous in relation to other notices. The LT11 looks more like a CP501, CP503, or a CP504 “Notice of Intent to Levy.”

The not-so obvious answer is “B.” The top “A” is from a CP504. the lower “B” is from a LT11.

conclusion seems to be consistent with IRM 5.11.1.3.3.1 (08-01-2014) which provides ... Recognizing if ACS Issued Notice of Intent to Levy/Notice of a Right to a Hearing.

- ACS also issues a Notice of Intent to Levy/Notice of a Right to a Hearing.

- If the ACS transcript shows action code LT11 on or after 1–19–1999 for the same liabilities that a revenue officer will be levying to collect, do not issue an L1058. An LT11 issued before 1–19–1999 was only a notice of intent to levy. It did not include the notice of a right to a hearing.

Read more at: Tax Times blog