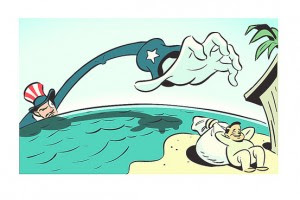

According to various news reports, US multinationals are "pushing" the US government to further reduce the tax rate on offshore profits. Major U.S. multinationals are pushing the Trump administration to deepen the tax break it has already tentatively proposed on $2.6 trillion in corporate profits being held offshore by more than 500 U.S. companies.

Nearly a third of that is held by 10 companies, including Apple, Microsoft Corp, Pfizer Inc and General Electric Co, the firm said.

These companies and hundreds of others could bring their foreign profits into the United States at any time, but they do not in order to avoid paying the 35-percent tax due.

President Trump's tax reform proposed to reduce the tax rate on the repatriation of offshore profits to 10 percent from 35 percent. However, lobbyists are making an aggressive case that cutting the tax rate on offshore profits to 10, as the administration has indicated it may favor, is not enough.

They propose a bifurcated rate of 3.5 percent on earnings already invested abroad in illiquid assets, and 8.75 percent on cash and liquid assets. Lobbyists are telling the White House and Treasury Department that if companies are forced to bring home, or repatriate, foreign earnings, they want a sharply reduced tax rate".

They propose a bifurcated rate of 3.5 percent on earnings already invested abroad in illiquid assets, and 8.75 percent on cash and liquid assets. Lobbyists are telling the White House and Treasury Department that if companies are forced to bring home, or repatriate, foreign earnings, they want a sharply reduced tax rate".

The deferral rule has incentivized multinationals to park profits offshore and about $2.6 trillion in earnings is being held overseas by more than 500 U.S. companies, according to Audit Analytics, a corporate research firm.

The deferral rule has incentivized multinationals to park profits offshore and about $2.6 trillion in earnings is being held overseas by more than 500 U.S. companies, according to Audit Analytics, a corporate research firm.

Nearly a third of that is held by 10 companies, including Apple, Microsoft Corp, Pfizer Inc. and General Electric Co. All four of those companies declined to comment. These companies and hundreds of others could bring their foreign profits into the United States at any time, but they do not in order to avoid paying the current 35-percent tax due.

If the $2.6 trillion overseas were repatriated at once, two things would happen. First, Washington would get a big jolt of tax revenue. Second, repatriated profits not collected by the Internal Revenue Service could be put to use in the economy.

The repatriation tax break now being discussed differs from Bush's: repatriation would not be voluntary, but mandatory, so foreign profits would have to be brought home.

In addition, lobbyists said they have talked to the administration about ending deferral and exempting foreign profits from taxation. The administration has floated this as an option. Lobbyists said there has been discussion about limiting that exemption to 95 percent of repatriated foreign earnings.

Sources:

Reuters

CNBC

President Trump (Contract with the American Voter, PDF)

Read more at: Tax Times blog