On May 8, 2017, we posted Is it Time to Expatriate? Your Neighbors Are, where we discussed that the Treasury Department published the names of individuals who renounced their U.S. citizenship or terminated their long-term U.S. residency “Expatriated” during the fourth quarter of 2016.

On May 8, 2017, we posted Is it Time to Expatriate? Your Neighbors Are, where we discussed that the Treasury Department published the names of individuals who renounced their U.S. citizenship or terminated their long-term U.S. residency “Expatriated” during the fourth quarter of 2016.

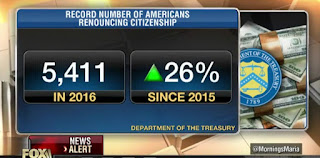

- The number of published expatriates for the quarter was 2,365, bringing the total number of published expatriates in 2016 to 5,411.

- The total for the 2016 year breaks the 2015’s record number of 4,279 published expatriates.

- The number of expatriates for 2016 is a 26% increase over 2015 and a 58% increase over 2014 (3,415).

Since then, the Tax Cuts and Jobs Act changed many, many parts of the Internal Revenue Code. The international tax rules, in particular, have been massively changed. But Congress did not touch Sections 877A or 2801 of the Internal Revenue Code. Those are the two special-purpose statutes that impose tax on people who renounce US citizenship or abandon their green cards.Therefore, someone who expatriates in 2018 will face the same tax laws that applied to someone expatriating in 2017, 2016, or before.

But for a certain group of Americans (mostly living abroad), the TCJA tax law radically increased the cost of keeping US citizenship. The economic incentives for renouncing citizenship or abandoning a green card, have tilted further in favor expatriation. It is now more expensive for these people to retain US citizenship.

The people who may want to rethink their citizenship, will be Americans, who own or invest in foreign businesses. Basically a US taxpayer with a US passport (or green card) and a business outside the United States. This group of people, entrepreneurs, investors, are the people we work with day in and day out. They face two new disincentives, created byof the Tax Cuts and Jobs Act of 2017:

The people who may want to rethink their citizenship, will be Americans, who own or invest in foreign businesses. Basically a US taxpayer with a US passport (or green card) and a business outside the United States. This group of people, entrepreneurs, investors, are the people we work with day in and day out. They face two new disincentives, created byof the Tax Cuts and Jobs Act of 2017: - Tax. Corporate profit that previously would not be taxed in the United States may now be taxed in the United States (GILTI Tax); and

- Professional Fees. The new tax laws add complexity and uncertainty.

The new tax laws created potential tax breaks for foreign corporations owned by US corporations. In many instances foreign profits flow upstream to the US parent corporation without further US tax.

For Americans who own foreign businesses which have been operating for 20 years, they might have million of dollars in retained earnings in their controlled foreign corporations.

They face of hundreds of thousands of dollars in US tax liability on prior years retained earnings, payable over eight years, starting with their 2017 tax return.

These changes in the 2017 TCJA in the final straw for Americans and we have received emails and calls from US taxpayers asking requesting information about expatriation.

International Income Tax Law?

Marini & Associates, P.A.

Read more at: Tax Times blog