REVIEW OF THE OFFICE OF APPEALS COLLECTION DUE PROCESS PROGRAM

Final Report issued on September 6, 2019. Highlights of Reference Number: 2019-10-058 to the Commissioner of Internal Revenue.

IMPACT ON TAXPAYERS

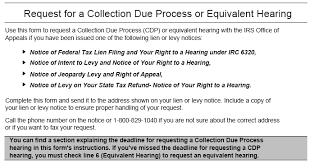

The Collection Due Process hearing provisions are designed to give taxpayers an opportunity for an independent review to ensure that the levy action that has been proposed or the Notice of Federal Tax Lien that has been filed is warranted and appropriate. An effective process is necessary to ensure that statutory requirements are met and taxpayers’ rights are protected.

WHY TIGTA DID THE AUDIT

This audit was initiated because TIGTA is statutorily required to determine whether the IRS complied with the required procedures under 26 United States Code Sections 6320 and 6330 when taxpayers exercised their rights to appeal the filing of a Notice of Federal Tax Lien or the issuance of a Notice of Intent to Levy.

WHAT TIGTA FOUND

Appeals properly informed taxpayers that Collection Due Process and Equivalent Hearings were conducted by an impartial hearing officer with no prior involvement with the tax or tax periods covered by the hearing. However, TIGTA identified some errors that were similar to errors identified in prior reports. Specifically, the Office of Appeals did not always classify taxpayer requests properly, and as a result, some taxpayers received the wrong type of hearing. TIGTA reviewed a statistically valid stratified sample of 140 cases and identified nine taxpayer cases that were misclassified. This is approximately the same number of misclassified cases that were identified in the prior year’s review.

Based on the same stratified sample, TIGTA determined that the Collection function did not timely process the hearing requests for an additional five taxpayers. When taxpayers mail or fax their hearing request to the wrong Collection function location, Collection function procedures require employees to fax the taxpayer’s request to the appropriate Collection Due Process Coordinator at the correct location on the same day. While the Office of Appeals provided taxpayers with the correct hearing type in these cases, the Collection function did not follow procedures. As a result, the IRS may not have adequately protected the taxpayers’ rights due to the untimely processing of the misdirected hearing requests.

In addition, TIGTA continued to identify errors related to the determination of the Collection Statute Expiration Date (CSED) on taxpayer accounts. TIGTA identified eight taxpayer cases that had an incorrect CSED. For five taxpayer cases, the IRS incorrectly extended the time period, allowing the IRS additional time to collect delinquent taxes. In the remaining three taxpayer cases, the IRS incorrectly decreased the time to collect the delinquent taxes. Overall, this is approximately the same number of CSED errors that were identified in the prior year’s review.

WHAT TIGTA RECOMMENDED

TIGTA recommended that the Director, Collection, take action to provide reasonable assurance that Collection function personnel forward misdirected Collection Due Process and Equivalent Hearing requests to the correct location on the same day the requests are received. TIGTA also recommended that the Chief, Appeals, update the inaccurate CSEDs for the eight taxpayer accounts that TIGTA identified with CSED errors. IRS management agreed with both recommendations and plans to take appropriate corrective actions.

READ THE FULL REPORT

To view the report, including the scope, methodology, and full IRS response, go to: https://www.treasury.gov/tigta/auditreports/2019reports/201910058fr.pdf.

Need to Appeal and IRS Tax Levy?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax HELP Contact Us at:

orToll Free at 888-8TaxAid (888) 882-9243

Read more at: Tax Times blog