As we discussed in Trends in IRS audits – Part I, the IRS’s auditing power has been greatly diminished in the past decade and according to accountinTODAY, while most taxpayers envision Internal Revenue Service audits as intrusive investigations resulting in criminal sentences. Today, nothing could be farther than the truth.

- Most audits are done by mail.

- The main issue in audits: The EITC. and

- An alarming amount of people do not respond to an audit

- The most common IRS challenge to a return is not an audit.

- The IRS knows who to audit

- Field audits are rare, but expensive.

- Want your business to escape audit?

8. Audits on the wealthy are still popular, but have dropped - In 2011, 1 out of every 8 taxpayers who earned more than $1 million in income were audited. In 2018, the number dropped to 1 in every 31 taxpayers. However, those who earn more than $1 million are still among the most popular audit profiles.

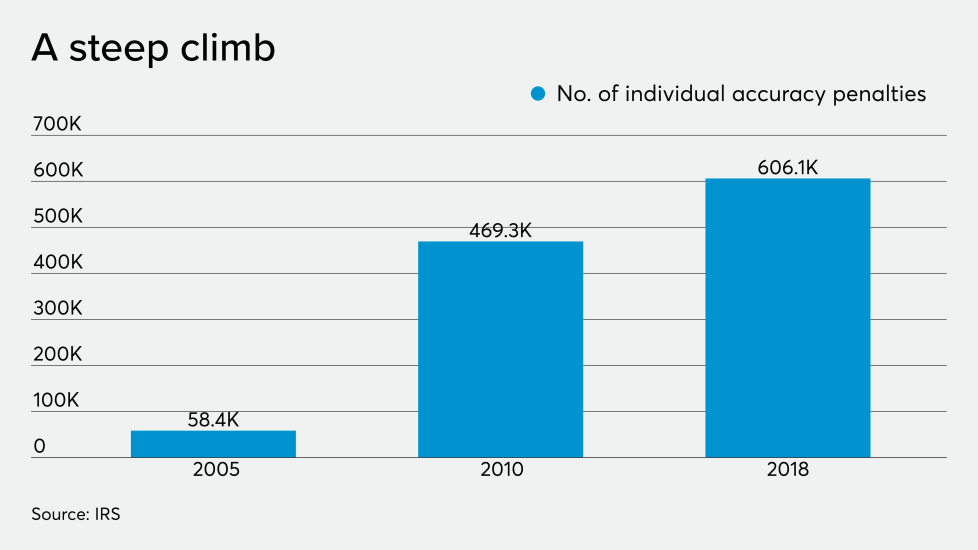

9. Audits have dropped, but penalties are still prevalent - The total volume of individual audits and CP2000 notices has dropped from 4 million in 2005 to 3.9 million in 2018. However, in 2018, 606,121 individual taxpayers were assessed the accuracy penalty for making an error on a tax return (audit or CP2000 notice). In 2005, that number was only 58,366. The moral here: If the IRS has to audit or send a CP2000 notice, it will now look to penalize errors to deter future noncompliance. The number of individual taxpayers with an accuracy penalty from an audit/CP2000 notice has increased 10 times since 2005.

10. Tax evasion prosecutions are low - Finally, the “fear of an audit” myth buster. The IRS does not like to publish this statistic. In 2018, there were only 636 indictments of legal source tax crimes. IRS tax evasion criminal investigation cases have dropped by 58 percent since 2013. The main source of IRS legal source tax crime cases are IRS field auditors and criminal investigators, i.e. revenue agents and special agents. From 2013 to 2018, the numbers of revenue agents and special agents have decreased by 26 percent and 21 percent, respectively. As a result, the number of criminal investigations and indictments continue to decline.

Realities and the IRS ability to close the tax gap

Fear of an audit has always been a main driver for compliance for the IRS. The 2018 Comprehensive Taxpayer Attitude Survey continued to show that 63 percent of taxpayers cited fear of an audit as an influential behavioral factor for correctly filing and timely paying their taxes. The tax gap, as currently measured on 2011-2013 returns, shows that the Treasury loses $352 billion a year due to inaccurate tax returns. With the fear of an audit becoming a myth, how will the IRS close the tax gap?

As the fear of an audit motivator becomes less of a reality, the IRS must seek to simulate the audit by touching as many taxpayers as they can. For now, that looks like sending a lot of non-audit notices to taxpayers. Recently, the Treasury Inspector General for Tax Administration

reported that the IRS sent over 219 million notices annually to taxpayers. In 2001, the number of notices sent was only 30 million. With the IRS’s current resources, the IRS notice may be the only means the IRS has to let taxpayers know that they are still there.

Have a IRS Audit Problem?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation Contact us at:

or Toll Free at 888-8TaxAid (888 882-9243).

Read more at: Tax Times blog