The Office of Chief Counsel, Internal Revenue Service, issued Chief Counsel Memorandum 201250020 on Dec. 14, 2012 stating that:

The Office of Chief Counsel, Internal Revenue Service, issued Chief Counsel Memorandum 201250020 on Dec. 14, 2012 stating that:

"The Service may disclose the third party return information in the exams of the unrelated taxpayers to the extent the documents satisfy the “item test” of section 6103(h)(4)(B)."

The documents satisfy the “item test” if they directly relate to an issue in

the case, i.e. an element to be proved in the case, not just that other similarly situated taxpayers participated in similar transactions."

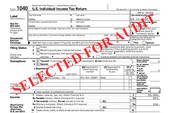

Need Experianced Representation for a Tax Audit?

Contact the Tax Lawyers at Marini & Associates, P.A. for a FREE Tax Consultation at: www.TaxAid.us or www.TaxLaw.ms or Toll Free at 888-8TaxAid (888 882-9243).

Read more at: Tax Times blog